IBPS PO Salary 2024 is really good and encourages people to apply for the job at public banks. The starting pay for this role is between 52,000 to 55,000 rupees. And there are more benefits on top of this. Keep reading to find out more.

The salary for IBPS PO in 2024 is a big reason why many people want to work in banking. Being a Probationary Officer is a respected job, and people from all over India take the exam because of the good pay. It’s said to be attractive and comes with lots of perks. So, it’s important for applicants to know all the details about the salary and the extra things they get.

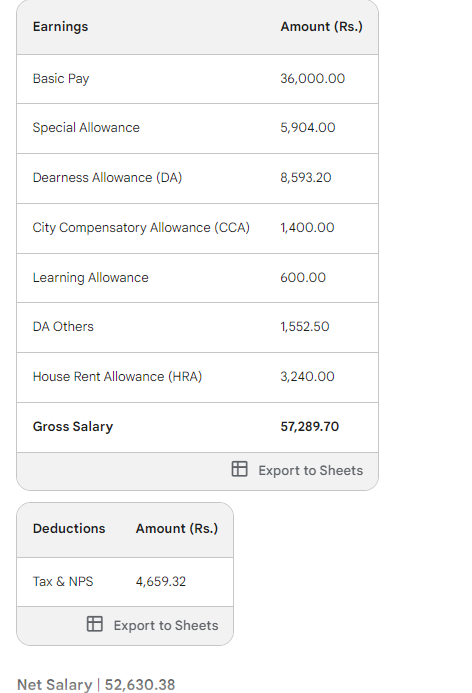

Right now, the basic pay for a PO is 36,000 rupees, and when you add up all the extra allowances, the total salary is about 57,289.70 rupees. But, there are some deductions like tax and NPS, so the actual take-home salary is around 52,630.38 rupees.

The new salary structure for IBPS PO has been decided by the 11th bipartite settlement. This settlement decides how much pay rises for Probationary Officers, Bank Employees, Staff, and Sub-Staff at Public Banks. According to this new deal, employees will get a 15% raise in their pay. And this is what public banks have to follow until a new deal comes out.

IBPS PO Salary 2024 – Basic Pay

The new IBPS PO salary plan, according to the 11th Bipartite settlement, starts at INR 36,000. Over time, this pay goes up based on how long someone has worked. After 7 years, it becomes Rs 42,860. Then, after 9 years, it goes to Rs 45,150. Finally, after 16 years (7 + 2 + 7), it reaches Rs 54,320.

This means IBPS is rewarding its Probationary Officers for sticking around and gaining experience. It’s like saying, “Hey, thanks for your hard work. Here’s a raise!” This helps keep employees happy and motivated to stay with the bank.

Knowing how your salary grows over time can help you plan your future better. It gives you a clear idea of what to expect as you progress in your career. So, if you’re thinking about joining IBPS, this salary plan could be a big plus!

IBPS PO Revised In-hand Salary 2024

Once recruited, bank employees, including IBPS POs, receive their salary slip along with their pay. This document is crucial as it contains essential details about their earnings, deductions, and overall salary structure. Here’s what you can expect to find on an official salary slip:

- Gross Pay: This is the total amount earned before any deductions are made. It includes basic pay, allowances, and any bonuses.

- Deductions: These are amounts subtracted from the gross pay. Common deductions include taxes, provident fund contributions, and insurance premiums.

- Net Pay: This is the final amount that the employee receives after all deductions have been made. It’s the actual amount that goes into the bank account.

- Breakdown of Allowances: The salary slip may provide a detailed breakdown of various allowances, such as house rent allowance (HRA), travel allowance, and medical allowance.

- Employee Details: Personal information such as employee name, employee ID, designation, and department are typically included on the salary slip.

- Period Covered: The salary slip indicates the period for which the salary is being paid, usually a specific month or pay period.

- Employer Details: Information about the employer, including the bank’s name, address, and other relevant details, may also be included.

| Allowances | Amount | Deductions/Recoveries | Amount |

|---|---|---|---|

| Basic Pay | 36,000.00 | Prof. Tax. | 200.00 |

| Dearness Allowance (DA) | 8,593.20 | NPS | 4,459.32 |

| House Rent Allowance (HRA) | 3,240.00 | ||

| City Compensatory Allowance | 1,400.00 | ||

| Special Allowance | 5,904.00 | ||

| DA Others | 1,552.50 | ||

| Learning Allowance | 600.00 | ||

| Gross Salary | 57,289.70 | Total Deductions | 4,659.32 |

| Net Salary | 52,630.38 |

IBPS PO In Hand Salary 2024

The IBPS PO salary structure is one of the main attractions for candidates eyeing this job role. Initially, the in-hand salary falls between Rs. 52,000 to 55,000, before any increments. However, this figure is subject to various allowances and deductions, which play a significant role in determining the final pay.

Let’s break down the components of the IBPS PO salary:

- Basic Salary: This forms the core of the salary package and typically ranges between Rs. 35,000 to 36,000.

- Dearness Allowance (DA): This allowance is a percentage of the basic salary and is adjusted based on inflation rates. Currently, it stands at 39.8% of the basic salary.

- House Rent Allowance (HRA): IBPS POs are entitled to HRA, which usually ranges between 7% to 9% of the basic salary. The actual amount varies depending on factors such as the city of posting and government regulations.

- Special Allowance: A portion of the basic salary, typically around 7.75%, is allocated as a special allowance. This allowance helps enhance the overall salary package.

- City Compensatory Allowance (CCA): IBPS POs also receive a city compensatory allowance, which is typically around 3% to 4% of the basic salary. The exact percentage may vary based on the location of the posting.

These allowances collectively contribute to enhancing the overall salary package for IBPS POs, making it an attractive proposition for job seekers in the banking sector. However, it’s essential to note that the actual figures may vary slightly based on government regulations, banking policies, and individual circumstances.

IBPS PO salary Deductions in 2024

| Particulars | Details |

|---|---|

| Union Fee | 150 |

| TDS | 830 |

| NPS | 3966 |

| Total Deductions | 4946 |

IBPS PO Additional Perks

Probationary Officers in banks enjoy various benefits beyond their salary. Here’s a breakdown of some perks they typically receive:

- Leased Accommodation: POs are entitled to leased accommodation, the scale of which depends on their place of posting, categorized as tier 1, tier 2, or tier 3 cities. Some banks even offer official bank accommodation or quarters instead of leased housing, ensuring officers have a comfortable place to live.

- Travelling Allowance: Most banks provide a fixed traveling allowance to POs to cover their commuting expenses. Additionally, they may reimburse petrol bills, making it convenient for officers to travel for work-related purposes.

- Medical Aid: Banks prioritize the health and well-being of their employees by offering medical aid. The revised amount for medical aid is Rs 80,000 per annum, which covers the medical needs of the officers and provides financial support during medical emergencies.

- Newspaper Reimbursement: To stay informed and updated, POs receive a fixed monthly amount for newspaper service. This reimbursement ensures that officers have access to valuable information that may aid them in their professional roles.

- Coverage under the New Pension Scheme (NPS): POs are covered under the New Pension Scheme, which is a government-sponsored pension scheme. This scheme provides financial security to employees post-retirement, ensuring they can lead a comfortable life even after their active working years.

Job profile of Probationary Officers

- Comprehensive Banking Knowledge: Candidates must have a solid understanding of various banking operations, including finance, accounting, billing, investment, and revenue collection.

- Effective Customer Service: POs should excel in resolving customer queries and concerns promptly and efficiently, ensuring a positive customer experience.

- Business Development: Candidates should be proactive in identifying and pursuing new business opportunities to contribute to branch growth and profitability.

- Transaction Oversight: POs are responsible for directing daily transaction activities and managing loan-related processes within the branch, ensuring accuracy and compliance.

- Customer Relationship Management: Building and maintaining strong relationships with customers is essential, including addressing grievances and feedback promptly and effectively.

- Branch Supervision: POs oversee the activities of their respective branches, ensuring smooth operations, adherence to regulations, and achievement of performance goals.

Career Growth of IBPS PO 2024

During the initial months of their employment, Probationary Officers (POs) undergo rigorous training to familiarize themselves with the tasks and responsibilities outlined earlier. This period serves as a probationary period during which they receive thorough guidance and instruction.

As they gain experience and demonstrate competence in their roles, POs become eligible for promotions to higher positions within the bank. These promotions are based on factors such as performance, experience, and knowledge.

However, before being promoted to a higher position, employees must successfully pass examinations administered by IBPS periodically to assess their proficiency and suitability for advancement.

The following are some of the roles to which POs are commonly promoted:

- Middle Manager – Middle Management Grade Scale 2

- Senior Manager – Middle Management Grade Scale 3

- Chief Manager – Senior Management Grade Scale 4

- Assistant General Manager – Senior Management Grade Scale 5

- Deputy General Manager – Top Management Grade Scale 6

- General Manager – Top Management Grade Scale 7

- Executive Director

- Chairman and Managing Director

These promotions represent significant milestones in a PO’s career progression, with each successive role offering greater responsibilities and opportunities for leadership and strategic decision-making within the organization.

Banks Participating in IBPS PO 2024 Recruitment Process

Here’s the table representing the list of banks participating in the IBPS PO 2023 recruitment process:

| No. | Bank |

|---|---|

| 01 | Bank of Baroda |

| 02 | Bank of India |

| 03 | Bank of Maharashtra |

| 04 | Canara Bank |

| 05 | Central Bank of India |

| 06 | Indian Bank |

| 07 | Indian Overseas Bank |

| 08 | Punjab National Bank |

| 09 | Punjab & Sind Bank |

| 10 | Union Bank of India |

| 11 | UCO Bank |

What is the salary of IBPS PO after 5 years?

The salary of an IBPS PO after 5 years varies based on factors like increments and allowances. However, typically it ranges between INR 60,000 to 70,000 per month.

Which bank salary is high?

The salary offered by banks can vary based on factors such as position, experience, and location. Generally, larger banks and private sector banks tend to offer higher salaries compared to smaller public sector banks. However, specific salary levels can vary, so it's essential to research and compare salaries offered by different banks for the desired position.

2 thoughts on “IBPS PO salary after 12th bipartite settlement, In-hand Salary, Pay Scale, Job Profile & Promotion”